Are you looking to upgrade your HVAC system while also saving some green? Well, you’re in luck because today we’re diving into the world of energy-efficient HVAC upgrades and how they can earn you some serious rebates and tax incentives. Get ready to learn how to keep your home comfortable, your wallet happy, and the planet healthy!

Understanding Energy Efficiency

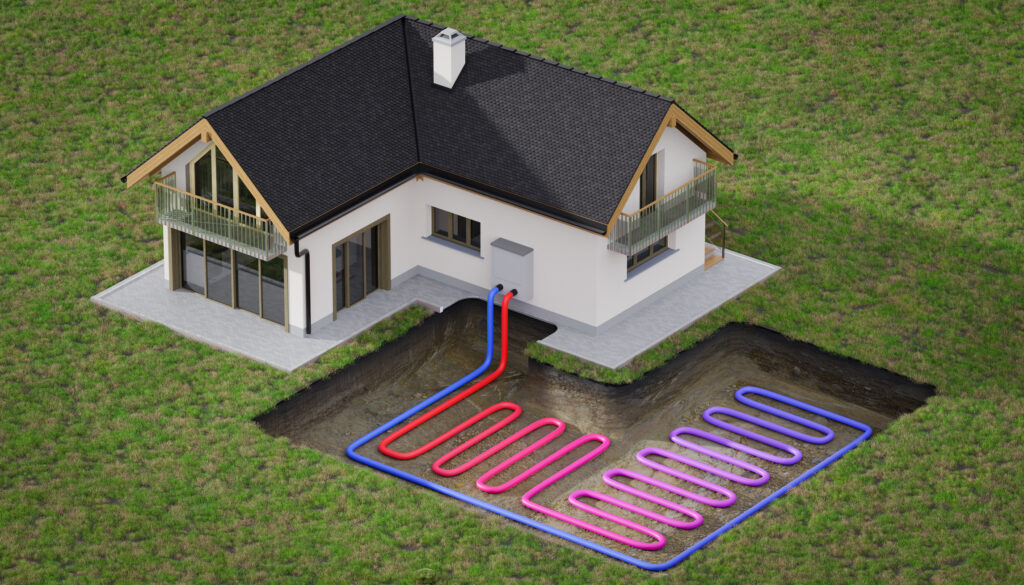

Let’s start by talking about what exactly we mean by “energy-efficient HVAC upgrades.” Essentially, these are upgrades or replacements to your heating, ventilation, and air conditioning systems that are designed to use less energy while still keeping your home cozy in the winter and cool in the summer. These upgrades can include everything from installing a programmable thermostat to upgrading to a high-efficiency mini split heat pump system.

Did you know that over $12,000 in rebates and incentives are available when you upgrade your current system? Call today to learn more!

The Tax Incentive Angle

Now, here’s where things get really interesting: did you know that the government actually rewards you for making these energy-efficient upgrades? That’s right! Through various tax incentive programs, Uncle Sam is encouraging homeowners like you to go green and reduce your energy consumption.

Through the Inflation Reduction Act, you can claim 30% of projects costs, up to $2,000, in tax credits. These credits can be combined with additional credits of up to $1,200 for other eligible upgrades made within the same tax year.

Qualifying for Tax Incentives

But how exactly do you qualify for these tax incentives? It’s actually pretty straightforward. Many energy-efficient HVAC upgrades are eligible for federal, state, and even local tax credits or deductions. These incentives can vary depending on where you live and the specific upgrades you make, but they can often translate into significant savings come tax time.

- Eligibility Criteria: Whether the experts at GEM help you select ducted or ductless mini-split heat pump systems, ensure they meet the following criteria:

- Ducted Systems: Your heat pump must proudly wear the ENERGY STAR Cold Climate label, boasting an EER2 greater than 10.

- Ductless Systems: ENERGY STAR Cold Climate heat pumps should flaunt SEER2 above 16, EER2 above 9, and HSPF2 above 9.5.

- These numbers simply reflect the efficiency of your heat pump. Factors like home size and existing ductwork play a role too.

Save with State Sponsored Rebates

Massachusetts and Rhode Island residents are in luck because both states offer some of the best rebate programs in the country through MassSave, Clean Heat RI, and Rhode Island Energy. In both states, it’s possible to save up to $10,000 in rebates on energy efficient HVAC services. This of course won’t apply to everyone, but most people will be able to utilize at least some of the rebates. Combine that with federal tax credits and financing through GEM, and the savings can be considerable!

The Bottom Line

So, what’s the bottom line here? Energy-efficient HVAC upgrades not only help you save money on your energy bills year-round, but they can also earn you some sweet tax incentives and rebates along the way. It’s a win-win for your wallet and the environment!

Next time you’re considering upgrading to an energy-efficient HVAC system, be sure to take advantage of any tax incentives and rebates that may be available to you. Your home, your wallet, and the planet will thank you for it!