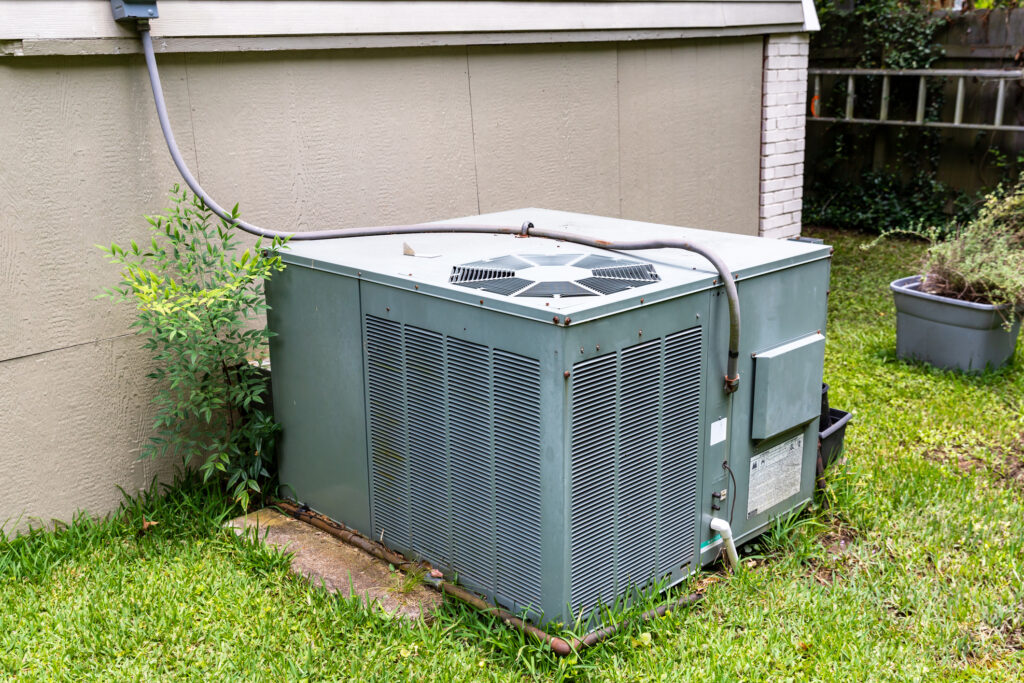

As tax season unfolds, let’s shift our perspective. While it’s not everyone’s favorite time of year, it doesn’t have to be all gloom and paperwork. If you installed an air source heat pump system in your home during 2023, you’re in for a potential tax credit!

Save Up to $2000 When You Upgrade to Energy-Efficient Heat Pump Technology

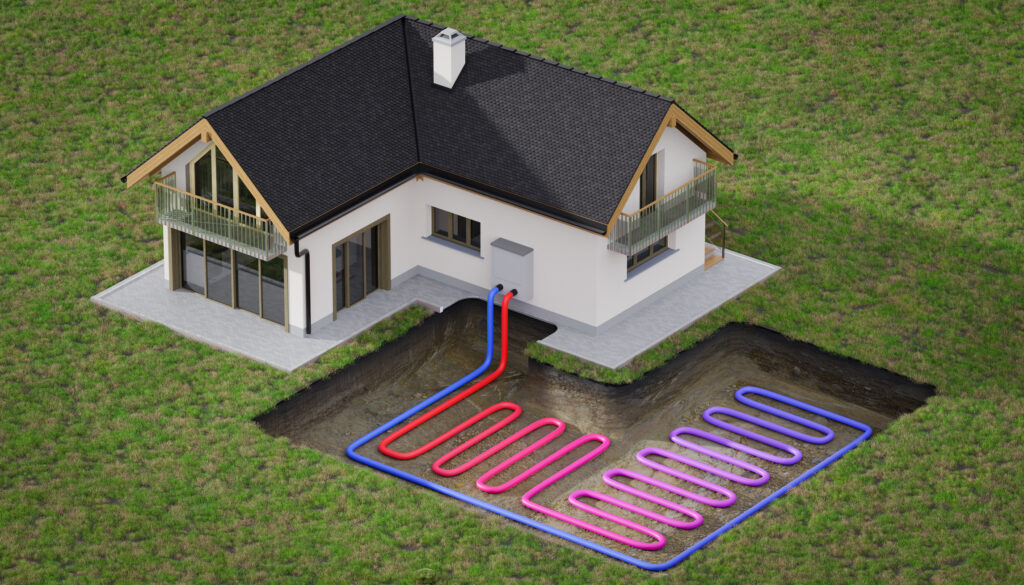

By embracing energy-efficient heat pump technology, you’re not only enhancing your home’s comfort but also unlocking financial benefits:

Heat Pump Tax Credits

Picture this—you can claim 30% of projects costs, up to $2,000, in tax credits. But wait, there’s more! These credits can be combined with additional credits of up to $1,200 for other eligible upgrades made within the same tax year.

Eligibility Criteria: Whether the experts at GEM help you select ducted or ductless mini-split heat pump systems, ensure they meet the following criteria:

- Ducted Systems: Your heat pump must proudly wear the ENERGY STAR Cold Climate label, boasting an EER2 greater than 10.

- Ductless Systems: ENERGY STAR Cold Climate heat pumps should flaunt SEER2 above 16, EER2 above 9, and HSPF2 above 9.5.

Don’t let the technical jargon intimidate you. These numbers simply reflect the efficiency of your heat pump. Factors like home size and existing ductwork play a role too.

Ready to Dive into Heat Pump Technology? Give us a call!

Not only will you save money, but you’ll also contribute to the United States’ transition to cleaner energy sources. Let the pros at GEM make your home cozier and more eco-friendly today!